Is DEEPROP A Missing Ingredient For More Efficient Fracking In Shale Wells?

Originally published on Forbes.com on May 19, 2021

What’s the use of proppant in fracking operations?

The shale revolution has occupied the first 20 years of the new century. It has enabled the US to become self-sufficient in oil and gas for the first time since 1947. Its benefits included cheap gas for cars, cheap heating for homes and offices, cheap plastics for car, home, and office.

The key to success was technology – a long horizontal well (up to two miles long) fracked up to 40 times along its length. Each fracking operation basically cracked up the shale rock around the horizontal well, and by using up to 40 separate fracking operations, the shale was cracked up along the entire length of the horizontal well.

Oil or gas molecules could find their way to a crack, and then hustle along a series of crack conduits to the horizontal well. Voila! a commercial well.

But one important step is missing. After fracking operations cease, the crack conduits tend to close under the intense stress of the rock. If they close, the oil and gas has no preferred pathways, and the well is not profitable.

The traditional antidote has been to inject proppant – a type of sand – into the well. The sand grains act to prop open the cracks and stop them from closing.

For shale oil or gas wells, what operators found out quickly was that conventional 20-40 sized sand, used for decades in fracking operations, could not be pumped into the cracks because the cracks in shale were too thin in width. It was like trying to fit walnuts into a crack in the sidewalk. They had to reduce the size of the proppant and found by trial and error the best sand was a mix of 100-mesh and 40-70.

For over 20 years, this has been the status quo. But in 2014, the position was challenged: finer sand should have an advantage because it would fit into smaller cracks and hold them open, and this would allow even more molecules of gas or oil to get to the wellbore.

The report told of a study on gas production from five shale wells, and the correlations implied that using more 100-mesh proppant in the fracking recipe led to greater gas production. But others argued theoretically for less 100-mesh sand because it was weaker than 40-70 mesh sand and less resistant to crushing by higher stresses trying to close the fractures.

DEEPROP technology.

In the last few years, a new type of proppant has come along. Its smaller in size than 100-mesh, rounder, and stronger, and it’s called DEEPROP. It is sometimes called microproppant because of its small size: 400-500 mesh (about 0.05 mm or 1/20 of a millimeter).

Bill Strobel, head of Zeeospheres Ceramic Inc., recently explained how DEEPROP works.

- What is DEEPROP?

DEEPROP is a tiny microproppant material that has been shown to increase well productivity by between 20-40% in multi-year trials, in over 250 wells in 6 major US shale plays. Mesh size of the proppant is 400-500 (0.05 mm). The particles are made of ceramic and are spherical.

- What are the advantages of DEEPROP?

DEEPROP allows operators to place proppant in smaller fractures, further from the wellbore and it has been shown to slow flowrate decline and increase estimated ultimate recovery (EUR) from a shale gas or shale oil well.

- Can you quote the production uplift in dollars?

Yes. For the Utica shale play, a 10-year cumulative oil forecast showed DEEPROP would increase the incremental production per thousand feet of lateral by 7,000 – 13,000 barrels. This converts to an additional revenue of $315,000 – $585,000 per thousand feet drilled.

- Does DEEPROP fit with the current economics of maintaining production and cash flow from shale wells instead of expanding production by drilling new wells?

Shale operators have relied on the expensive practice of continuously drilling and completing new wells because they need new wells to replace production lost in the first few years – a shale well typically declines 65% in its first year. Trial wells utilizing DEEPROP have reduced production decline rates that make it easier for operating companies to maintain production.

- Have other smaller-sized proppants been tried in wells?

Operators have tried running 400-500 mesh proppant in the past, but they were limited to silica flour, fumed silica, and high bauxite ceramic proppants (200-300 mesh). None of these products provided a noticeable production uplift. These proppants and DEEPROP® differ in two important ways:

- They have a low conductivity, especially the silica and fumed silica products.

- They have a low crush resistance, especially the silica and fumed silica products.

- What do you mean by low conductivity of other small proppants?

Inside a crack, silica flour, fumed silica, and angular heavy bauxite ceramics are going to stack together and stick together like Lego bricks, and will block the flow of gas or oil molecules. Crushing of the silica proppants will make this worse. The plugged crack will ruin the crack as a conduit for flow of gas or oil to the horizontal well. Sample images from the lab of fumed silica and silica flour show they are angular and more stackable than perfectly spherical DEEPROP.

- How much does DEEPROP cost? How long does it take to pay out?

The best way to answer this is that operators see a payback of investment typically in 1-3 months.

Case studies.

A new paper(Ref 1)has been publishedby SPE (society of Petroleum Engineers) and summarizes several comparisons of wells using DEEPROP (DP) versus offset (nearby) wells without DP:

Case 1 – Barnett Shale. 4,200 lb of DP was added to the pad (the initial stage of the fracking operation) at a concentration of 0.1 lb/gal. This is a very low concentration as proppant concentrations of 40-70 proppant generally peak at 2-3 lb/gal.

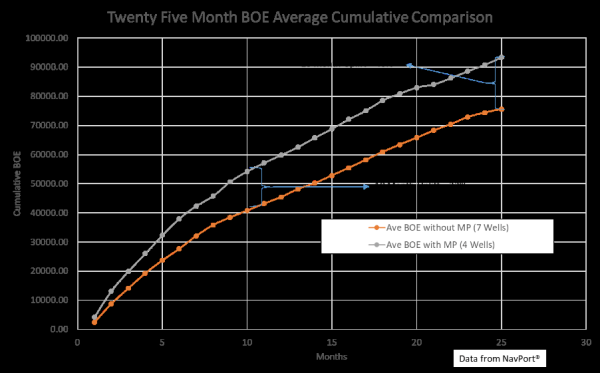

Figure 1 shows the average cumulative BOE (barrels of oil-equivalent) production for the four DP wells vs the seven offset wells. As can be seen in the plot, the wells start at about the same point but start to separate with the uplift continuing to improve over time – reaching 24% after 25 months. This is consistent with the idea of having a larger conductivity propped fracture area.

Figure 1. Twenty-five month BOE average cumulative production of the 11 wells used in the Barnett Shale study.

Case 2 – Woodford Shale (SCOOP).

One operator conducted a study using 7 DP wells offset by 12 non-DP wells. This work was first reported on by Calvin et al in SPE 184863. As with the Barnett wells 4200 lbs of the DP was added as a liquid slurry into the pad at a concentration equivalent to 0.1 lb/gal.

The main reason this operator was using the DP was to reduce the frac pumping pressure. The pressure limit on the wellbore was 11,500 psi but the MP removed 800 – 1100 psi pumping pressure which allowed the frac treatment to be placed at a higher pump rate which effectively exposed more shale rock.

The uplift was impressive: 72% after 24 months and 81% after 36 months (Figure 2).

Takeaways:

Statistics are important in shale wells because it is well known that the variability from well to well in a shale play is large. Many wells are required to establish a trend, or in this study a difference between wells with DP versus wells with no DP.

Two cases studies show statistically-conclusive results:

- The Barnett shale tests indicate an average production uplift of 24% after 25 months, and this has been attributed to a larger conductivity propped fracture area when using DP.

- The Woodford Shale (SCOOP) trials lowered the frac pumping pressure which extended the fracture reach. The average production uplift was 72% after 24 months and 81% after 36 months. This is evidence for near-wellbore scouring of blockages by DP.

Other field tests are underway, but these will require comparisons between at least half-a-dozen wells that used DP and a similar number of offset wells without DP, before statistically viable conclusions can be drawn.

These two cases with conclusive results show production uplifts that were substantial and typically paid out in 1-3 months. The results clearly warrant further field trials to determine optimal concentrations and timing for adding DEEPROP to a fracking schedule.

DEEPROP may turn out to be a Cinderella of proppant technology for even more successful shale-oil and shale-gas wells.

Reference 1: Carl Montgomery et al.: Utilizing Discrete Fracture Modeling and Microproppant to Predict and Sustain Production Improvements in Nano Darcy Rock, SPE-199741-MS. February 5, 2020.